UPDATE

October 17, 2024

Apple celebrates 10 years of Apple Pay

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, reflects on a decade of Apple Pay enriching users’ lives, and shares new ways to pay with Apple Pay, including rewards and installments

When we started our journey with Apple Pay 10 years ago, we saw a unique opportunity to leverage Apple’s hardware and software to make a meaningful impact on the financial health and lives of our customers. From the outset, we envisioned a world where you could use your iPhone to seamlessly pay for everything — from groceries to train tickets, in person and online, across the globe — all while keeping your personal and financial information safe and private.

Today, Apple Pay is used by hundreds of millions of consumers in 78 markets, at checkout on millions of websites and apps, in tens of millions of stores worldwide, and is supported by more than 11,000 bank and network partners. We hear from customers every day about how much they love the ease, security, and privacy protections Apple Pay provides in their daily lives, and how much they enjoy using it across their devices — including iPhone, Apple Watch, iPad, and Mac.

One of my earliest memories of realizing how Apple Pay was positively impacting consumers’ lives was when we rolled out Apple Pay for transit in Tokyo, which is used by millions of travelers every day. I watched in awe as people quickly tapped their iPhone or Apple Watch to pay while passing through the turnstiles — no need to fish out any cash, cards, or coins from their wallets, or even unlock or wake their device. It’s a great example of how Apple Pay’s seamless and secure customer experience delivers convenience and peace of mind to consumers around the world, whether they’re commuting to work, shopping online, or picking up their morning coffee.

We know how important it is for customers to feel secure and trust that their financial transactions are private when making a payment. That’s why we’re always working to safeguard consumers, while also enabling banks to have industry-low levels of fraud for Apple Pay transactions. And it’s also why Apple Pay was designed to protect users’ highly sensitive personal and financial information, like their card number, which is never shared with merchants. Our customers trust that when they use Apple Pay anywhere, they can have the peace of mind that their payments are protected.

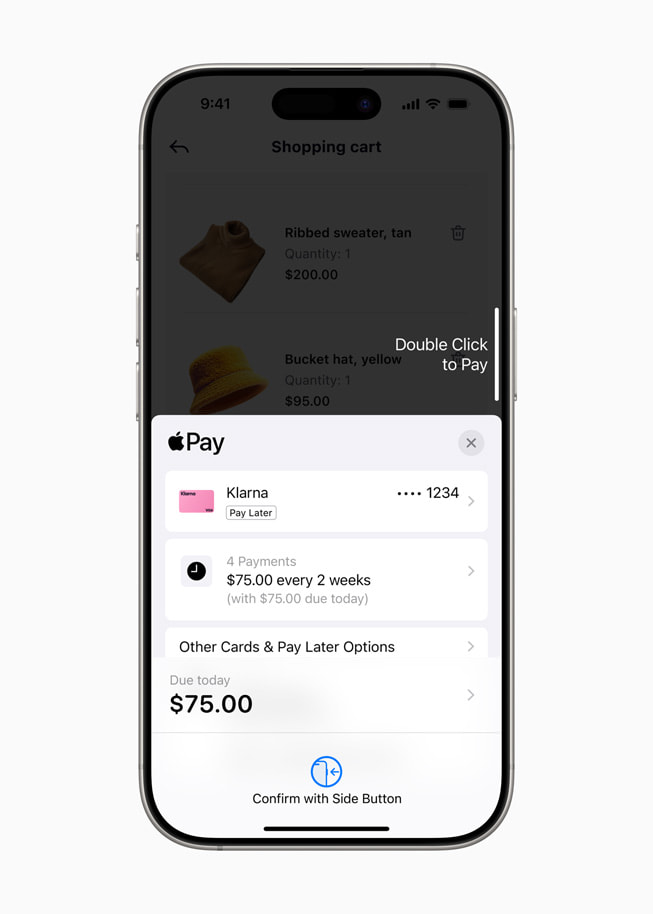

Looking ahead at what’s next for Apple Pay, we are excited to now bring our users more ways to pay, including the option to redeem rewards and access installment loans from Apple Pay-enabled issuers and lenders right at checkout with Apple Pay online and in-app on iPhone and iPad. This gives consumers greater flexibility in how they pay with the easy and trusted Apple Pay experience they already know and love. It also provides Apple Pay-enabled issuers and lenders with new ways to connect with their customers, and make their rewards and installment offerings even more accessible.

Beyond payments, we’re also advancing our broader vision of replacing users’ physical wallets with an easy, secure, and private digital wallet — Apple Wallet. Today, users can seamlessly and securely add and access eligible event tickets, transit cards, keys, government IDs, and more all from Apple Wallet. And we’re always looking for new ways to make using Apple Wallet convenient while delivering unparalleled security and peace of mind.

The last decade was an incredible journey, and we’re thrilled that so many people around the world are enjoying the experience that Apple Pay and Apple Wallet provide. I can’t wait to see what the next 10 years have in store.

— Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet

More Ways to Pay with Apple Pay

With iOS 18, eligible users can now access installment loan options from Affirm in the U.S. and from Monzo Flex in the U.K. when checking out with Apple Pay online and in-app on iPhone and iPad.1 And starting today, eligible users in the U.S. and U.K. will also have the option to access Klarna’s flexible payment options right at checkout online and in-app with Apple Pay on iPhone and iPad.

In the future, users will also be able to access installment payment options from eligible credit or debit cards when making online purchases with Apple Pay in the U.S. with Citi, Synchrony, and across eligible, participating Apple Pay issuers with Fiserv; in Australia with ANZ; in Singapore with DBS; in Spain with CaixaBank; and in the U.K. with HSBC, NewDay, and Zilch, with more issuers to follow. Users in Canada will also have access to Klarna’s flexible payment options at checkout with Apple Pay online and in-app on iPhone and iPad in the future.

Additionally, with iOS 18 and iPadOS 18, Apple Pay users in the U.S. can now redeem rewards with eligible Discover credit cards2 when they check out with Apple Pay online and in-app on iPhone and iPad.3 In the future, users will also be able to redeem rewards for purchases with Apple Pay in the U.S. with Synchrony and across eligible, participating Apple Pay issuers with Fiserv and FIS, and in Singapore with DBS, with more issuers to follow.

Users can now also access Apple Pay on third-party web browsers and computers.4 At checkout, users will be prompted to use their iPhone or iPad to scan a code, and will then be able to securely complete the payment with Apple Pay on iPhone or iPad. And with Tap to Provision, it’s even easier for users to add a credit or debit card to Apple Wallet by simply tapping their eligible card to the back of their iPhone.5

Next year, customers in the U.S. will also be able to see their PayPal balance when using their PayPal debit card in Apple Wallet, giving them greater visibility and confidence when shopping.

Share article

Media

-

Text of this article

-

Images in this article

- Loans not offered by Apple. All loans are offered by the lending provider and are subject to the lending provider’s eligibility requirements and approval, as well as other lending provider terms. Not available in all markets, and may not be available for all types of purchases, such as subscriptions and recurring transactions. iOS 18 or iPadOS 18 or later required.

- Redemptions used with Discover credit cards will be reflected as a statement credit on a customer’s account.

- This feature is offered by a card’s issuer, and is subject to issuer eligibility requirements and other issuer terms. This feature is not available in all markets, and may not be available for all types of purchases, such as subscriptions and recurring transactions. The full amount of the transaction will be charged to the user’s card at the time of their purchase, and a statement credit for the redeemed reward amount will be applied to the user’s account.

- iOS 18 or iPadOS 18 or later required. Available with participating merchants on compatible browsers. Compatible browsers require WebSocket support. This feature is not available in all markets.

- Must have an eligible and supported card. Not available in all markets. To use this feature, a card’s NFC technology must be activated, and the user may need to enter their card’s security code during setup. Software requirements apply. To ensure a user has all features of this product, their iPhone must be updated to the latest software version.

In the U.S., Apple Pay is a service provided by Apple Payments Services LLC, a subsidiary of Apple Inc. In other countries and regions, Apple Pay is a service provided by certain Apple affiliates, as designated by the Apple Pay privacy notice. Neither Apple Inc., nor Apple Payments Services LLC, nor its affiliates are a bank. Any card used in Apple Pay is offered by the card issuer.

The survey was commissioned by Apple and conducted by Morning Consult between September 10-13, 2024, among a sample of 3,014 adults in the U.S. ages 18-64.

The survey was commissioned by Apple and conducted by Morning Consult between September 10-13, 2024, among a sample of 3,014 adults in the U.S. ages 18-64.